3 Stocks to Plug Into the AI Screener

Welcome to the AI Screener.

You can access it here if you haven't already.

Thousands of stocks are exposed to the massive investment flows and opportunities being created by AI.

We've identified the industries most impacted by AI right now... and the ones that will be transformed for years to come.

And we've made a quick and simple tool to help you understand which companies in those industries are set to thrive... which are just a bunch of hype and promise... and which are something in between.

The AI Screener shows you everything you need to know about a company at a glance.

You'll see grades for a stock's quality, how cheap or expensive it is, and any hidden risks in its accounting, balance sheet, or strategy.

It's a "one-stop shop" for investors who need all the info.

In a nutshell, here's how it works...

- If the AI Screener gives a stock an "A" grade, then the stock has a strong chance of outperforming the market going forward.

- If the AI Screener gives a stock a "C" grade, then you don't need to spend a lot of time on the stock.

- If the AI Screener gives a stock an "F" grade, then the stock could be a torpedo that might sink your portfolio's performance.

The AI Screener brings together thousands of data points from more than 20 years of history. Then, it applies the over 130 adjustments needed under Uniform Accounting.

(Uniform Accounting gets rid of all the noise on Wall Street... and zooms in on what's really going on with a company.)

The data behind this tool has pointed us to plenty of winners... using a secret of the investment world that I'll cover in my AI Panic Summit event on Thursday, July 18 at 1 p.m. Eastern time.

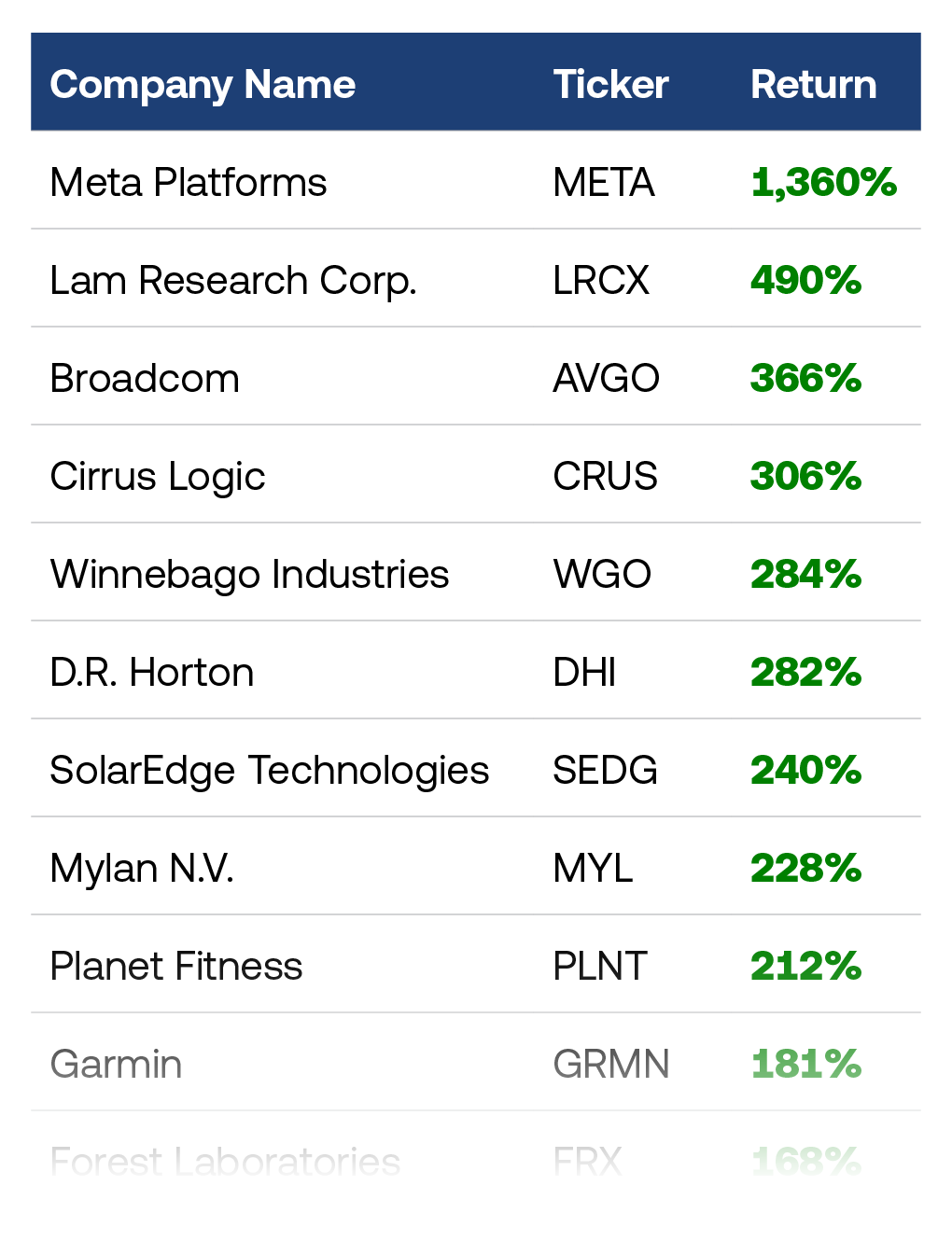

Here's just a snapshot of the gains our system has pointed to...

For almost 30 years, I've been poring over financial statements to get to the bottom of real corporate earning power. I've seen firsthand how Wall Street focuses on getting its corporate clients rich... and doesn't worry about the average mom-and-pop investor.

That's why, after the 2008 crash, I gave my regrets to Wall Street and left to create a new way of looking at stock analysis.

It's a way to see which stocks are set to win... powered by an international team going through thousands of lines of data... all of which is sorted by the AI Screener.

Until Thursday, July 18 at 1 p.m. Eastern time, I'm giving you a trial version of the AI Screener to see for yourself the power of the data at your fingertips.

Here are just three stocks that we wanted to show you...

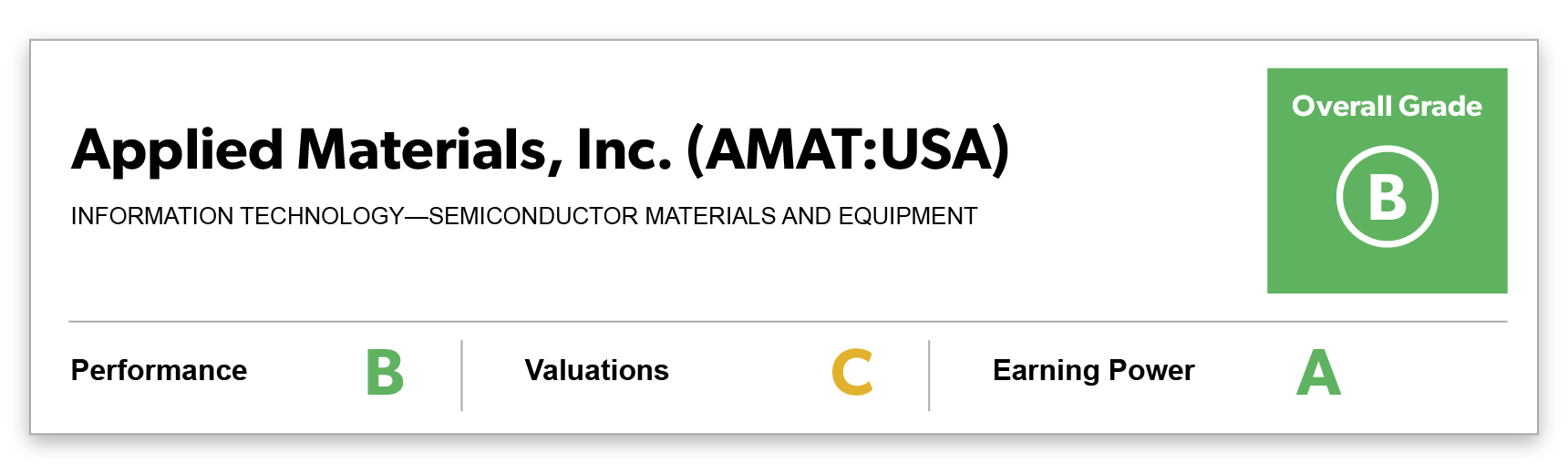

Stock No. 1: Applied Materials (AMAT)

If you type this stock into the AI Screener today... you'll get an overall "B" grade.

Applied Materials supplies equipment for semiconductor foundries – the factories that make chips.

You've probably heard that Sam Altman, the head of OpenAI and the face of the AI explosion, wants to raise trillions of dollars to build new foundries and make new chips. He sees it as the only way to fully realize the opportunity in AI.

Well, that means a ton of demand for the exact type of equipment that Applied Materials makes.

Applied Materials is at the center of this massive transformation. And the AI Screener will tell you the company has first-class returns... well above its peers.

If that wasn't enough, the company is also trading at a discount to those peers. It's not priced for the AI boom as much as many of its competitors.

And there are no risks on Applied Materials' balance sheet that could hold back its growth...

On Thursday, July 18 at 1 p.m. Eastern time, I'll explain exactly how the AI Screener works to predict potential huge stock moves.

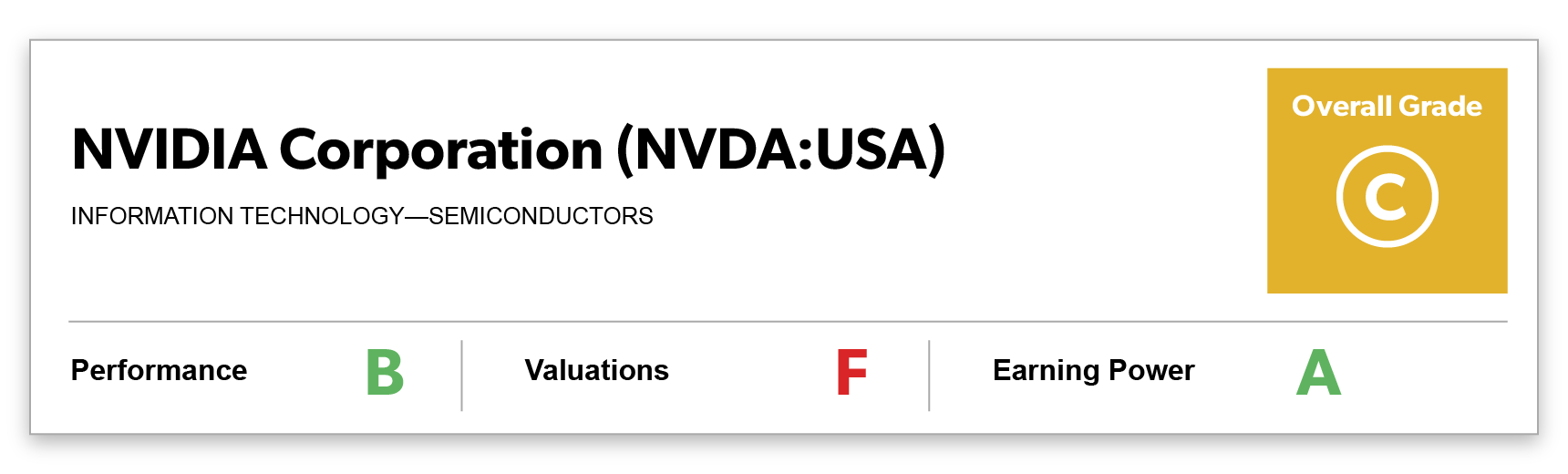

Stock No. 2: Nvidia (NVDA)

The moment you say the letters "AI," every investor in the room thinks of Nvidia.

Nvidia's graphics processing units ("GPUs") are the lifeblood of the AI boom. They can handle complex calculations... And when chained together in the right ways with the right code, they almost act like neurons in a human brain.

So it's no surprise that Nvidia has ridden a tsunami of growth. Uniform return on assets ("ROA") rocketed from 26% in 2023 to a forecast 118% this year.

Nvidia gets a strong "B" grade for Performance. It's hard to fuel a global transformation this big and not mint money in the process.

The issue is Nvidia's $3 trillion market cap. The market has already caught on to this story... and then some.

Nvidia's earnings grew by more than 4 times this year... and investors are pricing them to grow another 5 times in the next few years. Its Uniform price-to-earnings (P/E) ratio is at nosebleed levels. And folks are already pricing its sky-high returns to shoot out of the stratosphere.

Nvidia is priced for perfection. Even if it keeps on dominating, the market will just be satisfied... not more excited.

Plenty of investors are still loading up on Nvidia stock. The savviest will be more patient. The AI Screener gives this market darling a "C" grade overall.

Stock No. 3: Tesla (TSLA)

No matter what you have to say about Elon Musk... it's hard to argue that he's not a good showman.

Musk has managed to put his car company front and center for every fad, from the obvious electric-vehicle ("EV") trend to solar energy and battery solutions. And now, he's turning to AI.

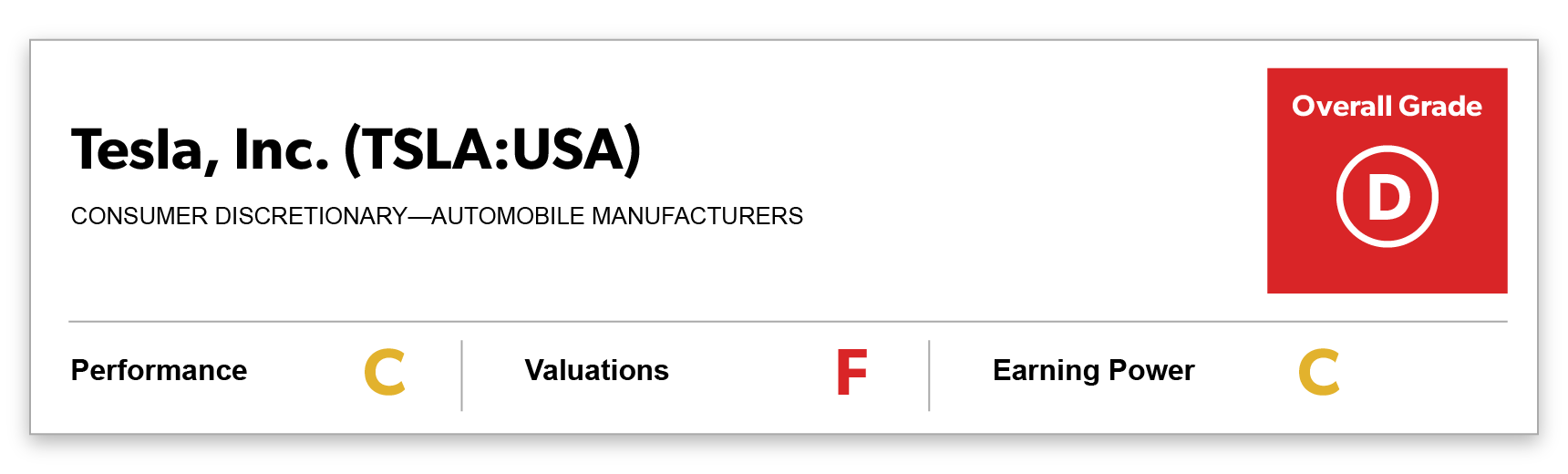

Mind you, it's not clear how much Tesla really is or will be an AI stock. Maybe that's why it gets an overall "D" rating on the AI Screener.

Tesla likes to talk about autonomous driving and its AI potential. In reality, it's actually reducing its follow-through on those promises.

While Musk's followers love to talk about the AI he could build at Tesla... most of his AI work has been more closely connected to his private investment in X (formerly Twitter).

He even redirected orders for AI chips from Tesla to X a few months ago to fuel that investment.

And at the end of the day, Tesla is an auto company first and foremost... an industry that lives with breakeven returns, year in and year out. The market for cars is oversaturated. Even Tesla can't fix that.

The company's returns are in decline, earning an "F" for Earning Power Growth. Between that downtrend, Tesla's exaggerated AI promises, and an overhyped investor base... this isn't a setup for a winning investment.

It doesn't matter that shares popped recently when Tesla beat (already massively lowered) estimates for car deliveries. Its share of the U.S. EV market just fell below 50% for the first time ever.

This business had a first-mover advantage. That's not the same as a lasting advantage.

If you own Tesla, it's time to get out while you still can.

Prepare for Thursday, July 18

By now, you should better understand the power of having grades for almost every AI company at your fingertips.

On Thursday, July 18 at 1 p.m. Eastern time, I'm hosting an urgent summit to walk you through the headwinds and tailwinds driving these three stocks... and others like them.

Plus, I'll give away the name and ticker symbol of an AI stock I love today.

Unlike many overhyped AI wannabes, this company is actually using AI to make its business better. And some of the largest companies in the world will have no choice but to rely on it going forward...

I'll show you why the AI Screener is flashing green on this stock... and the huge amount of upside the market is leaving on the table.

This is the same way we helped identify Facebook – now called Meta Platforms (META) – for our institutional clients in May 2013, before it soared 1,300%... and told them to exit four months before the stock dropped double digits.

It's the same framework that helped us identify Lam Research (LRCX) for our Altimetry subscribers for a 112% combined gain... and real estate tech stock eXp World (EXPI) before it soared 860%.

You'll hear from me on Thursday, July 18 at 1 p.m. Eastern time. I hope to see you there.

Joel Litman

Chief Investment Strategist, Altimetry

July 2024